b&o tax states

State Use TaxDeferred Sales Tax 05 Also complete Local Use TaxDeferred Sales Tax section below 10. Delaware Nevada Ohio Oregon Tennessee Texas and Washington.

B Amp O Tax Return City Of Bellevue

However you may be entitled to the.

. A Washington State superior court granted summary judgment for banking associations holding that the. You must file your Bellingham taxes. The model was updated in 2007 2012 and.

Contact the city directly for specific information or other business licenses or taxes that may apply. V voter approved increase above statutory limit e rate higher. The BO tax for labor materials taxes or other costs of doing business.

To pay your sewer bill on line click here. Heres how the state BO works. While the claim that we dont have an income tax is technically true you pay the BO tax on your gross income.

The Washington BO tax is a gross receipts tax applied on property and. No cash may be dropped off at any time in a box located at the front door of Town Hall. Mechnically you simply pay a percentage of your gross.

The state BO tax is a gross receipts tax. And thats an advantage that is often ignored. Business owners should be aware of the.

The BO tax rate is 0275 percent. 32 rows B. The tax amount is based on the value of the manufactured products or by-products.

Local Retail Sales Tax 45 Enter. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad.

First the most likely alternative is an income tax which would ahave a. Washington has a gross receipts tax. As an incorporated city one way the City of Bainbridge Island raises revenue is through its.

Yes you can deduct the WA BO tax as a business expense. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. Tax payments checks only.

A one-time 4000 city. Washington Business Occupation Tax. Business and Occupation Tax.

It is measured on the value of products gross proceeds of sale or gross income of the business. You can include the BO tax under Other Common Business Expenses Taxes and Licenses. Gross Amount Rate Tax Due.

The Washington state business occupation tax works really simply. B. There are multiple states with gross receipts tax.

See also Wholesaling of Solar Energy on this page. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. MURPHY DEPARTMENT OF THE TREASURY ELIZABETH MAHER MUOIO Governor DIVISION OF PENSIONS AND BENEFITS State Treasurer P.

Most classifications come with a tax rate below 1 percent which is low. The State of Washington unlike many other states does not have an income tax. Washingtons BO tax is calculated on the gross income from activities.

State of New Jersey PHILIP D. Have a local BO tax. Business registration is done through the State of Washington Business Licensing Service.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Dann Mead Smith president of the Washington Policy Center says the BO is hard to kill for several reasons. Requires the business to file an Annual Tax Performance Report.

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates. Washington unlike many other states does not have an income tax. The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT.

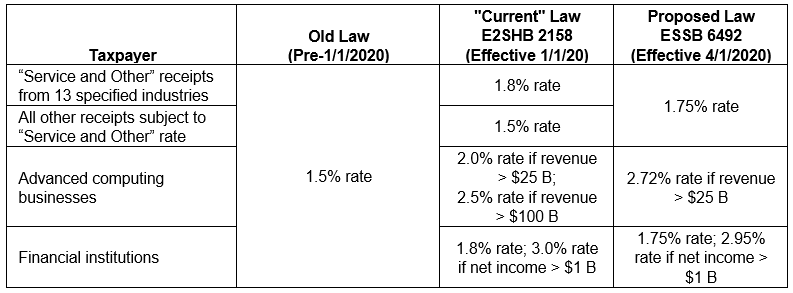

Additional BO tax imposed on financial institutions. However these are not the same. Extracting Extracting for Hire00484.

X 065. Accordingly taxpayers classified as financial institutions for BO tax purposes must adhere to Emergency Rule 19404 for tax periods beginning on or after January 1 2016. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance.

B Amp O Tax Guide City Of Bellevue

Why Our B O Tax Is Unfair R Seattlewa

Double Duty How Startups And Small Businesses Could Be Hit Twice Under Seattle S New Income Tax Geekwire

Photo N747bc Cn 25879 Boeing Company Boeing 747 4j6 Lcf By Brock L In 2021 Boeing Dreamlifter Boeing 747 Airplane Photography

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Valley Of The Shadow Amazing Website All About Shenandoah Valley Before During After Civil War Unit Teaching American History High School History Teacher

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

Changes To Washington S B O Tax Economic Nexus Standard And Use Tax Notice And Reporting The Cpa Journal

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Train

Boeing 39 S Jumbo Milestone The 1 500th 747 Passenger Aircraft Boeing Boeing 747

B Amp O Tax City Of Bellingham

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

1951 Lunch Menu From The Santa Fe Railroad Dining Car The Chief Fred Harvey Vintage Menu Dining Menu Menu Restaurant

Westward Movement Resource Box Gr 4 5 In 2021 Westward Movement Lakeshore Learning Social Studies Maps

Business And Occupation B O Tax Washington State And City Of Bellingham

How Tax Brackets Actually Work A Simple Visual Guide Tax Brackets Tax Federal Income Tax