do nonprofits pay taxes on interest income

Furthermore any nonprofit that earns income on activities not directly related to their purpose will need to pay income taxes for those earnings. For tax years beginning after Dec.

Business Nonprofit Fundraising Ideas Capital Gains Tax Capital Gain Tax Credits

That said youll want to check your local rules in case they.

. In most cases they wont owe income taxes at the. Just because you have a tax-exempt status it does not mean that youre well tax. General Rule By and large interest is not subject to income tax for nonprofit corporations.

If your NPO has received or is eligible to receive taxable. All nonprofits are exempt from federal corporate income taxes. Whether or not that income is taxable depends on whether the activities are related to the nonprofits purpose.

First and foremost they arent required to pay federal income taxes. A married couple for example does not pay any taxes on. Whether a nonprofit corporations interest is subject to income tax depends the incomes source.

You and your nonprofit employer share this and the. There are other types of exempt nonprofits such as 501c4 social welfare organizations. If your organization has 10000 or less in annual gross receipts you pay a 400 user fee to apply.

While it is true that under most circumstances tax-exempt organizations are not subject to a corporate level income tax as their taxable entity counterparts are required to. Nonprofits are of course not exempt. You must pay Social Security tax on your earnings of 10828 or more if youre an employee of a nonprofit organization.

In the US dividends are considered income for tax purposes. Nonprofits and churches do not have to pay federal income tax nor do they have to pay any state or local income tax. However this corporate status does not.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. And if you have over 10000 in annual gross receipts you pay a user fee of. Even then tax-exempt non-profit organizations which do not further qualify as a public charity still have to pay a federal income tax of either 1 or 2 of their investment gains.

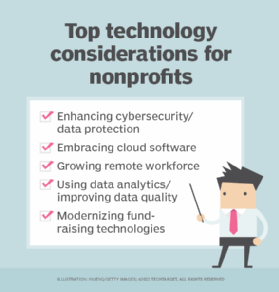

20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. Nonprofits are organizations that operate for the collective public and private interest without aiming to generate profits for the founders. Did you know that sometimes nonprofits must pay income tax.

In addition to federal income taxes 501 c. Most nonprofits fall into this category and enjoy numerous tax benefits. However they are usually taxed differently than regular income.

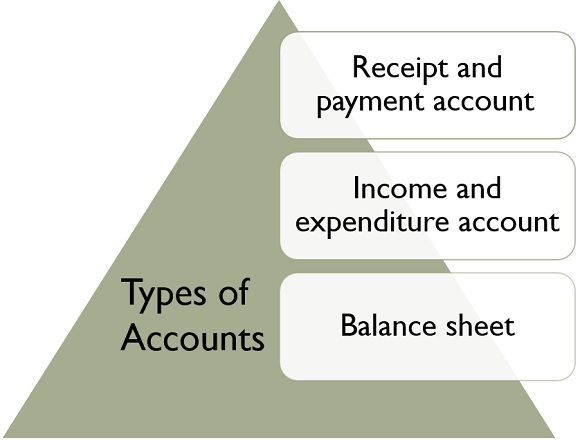

Entities organized under Section 501 c 3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which includes income and capital. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. Most are also exempt from state and local property and sales taxes.

Making a Profit From Activities Related to Your Nonprofits Work. Nonprofits are exempt from federal income taxes based on IRS subsection 501c. For tax years beginning on or before Dec.

While a qualified Non-Profit does not have to pay any taxes it still must file a Form 990 with the IRS every year. June 30 2021. This form is due on the 15th day of the 5th month following the end of the Non.

Your nonprofit probably wont have to pay federal income tax or state income taxes as long as youve applied for tax-exempt status with the IRS and presented the letter of. In the United States a nonprofit business generally is allowed to earn interest on a checking account and some banks even offer interest-paying checking accounts specifically.

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Statement Of Financial Activities Nonprofit Accounting Basics

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

What Is A Nonprofit Organization Npo

Infographic What Is A Nonprofit By Cullinane Law For Any Assistance Related To Legal Aspect Of Nonp Nonprofit Startup Start A Non Profit Nonprofit Marketing

Difference Between Charity Think Tank Business Administration

40 Non Profit Budget Template Desalas Template Budget Template Budgeting Nonprofit Startup

What Is Non Profit Organization Types Formats Advantages And Disadvantages The Investors Book

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Understanding Nonprofit Financial Statements Statement Template Personal Financial Statement Financial Statement

Online Ngo Registration Process In India Section 8 Company Company Benefits Company Taxact

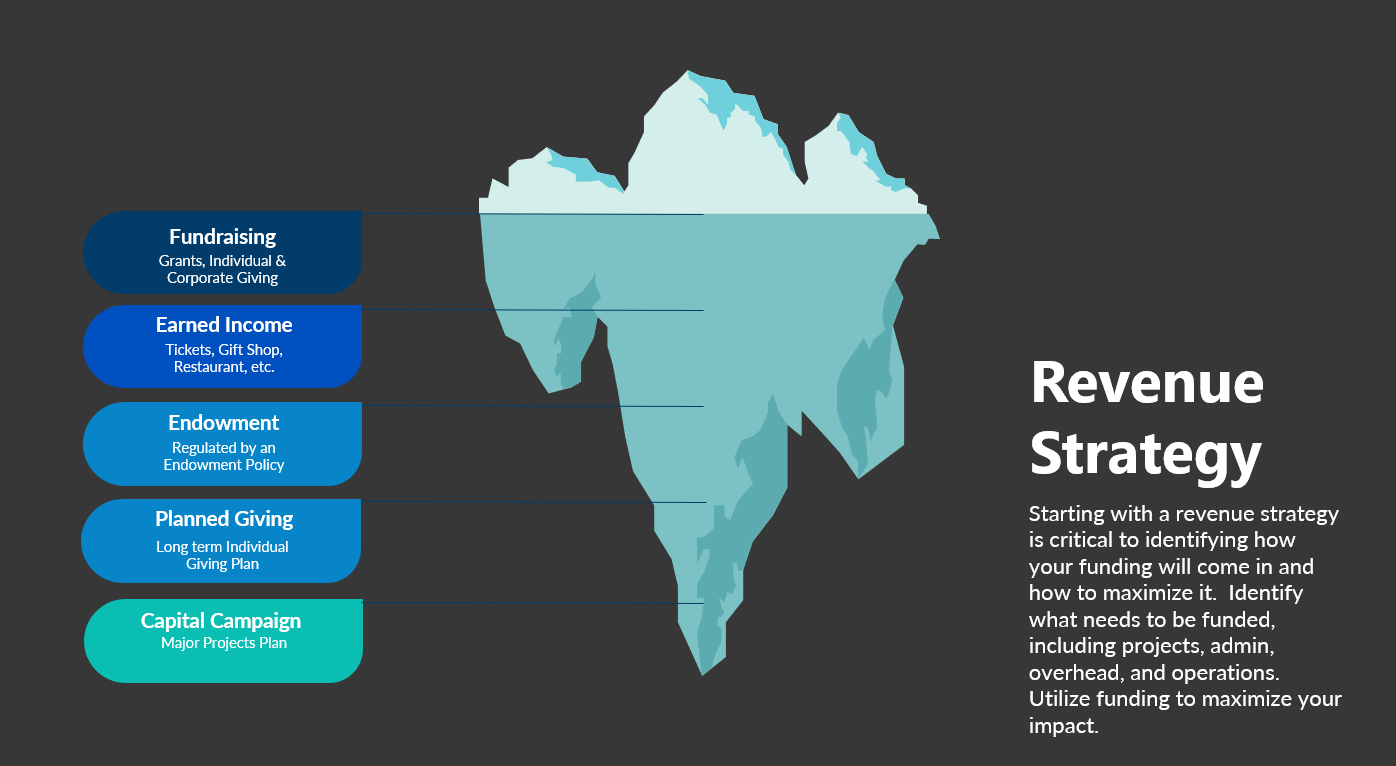

Maximizing Nonprofit Revenue Streams Nmbl Strategies

Nonprofit Sample Documents Nonprofit Startup Non Profit Nonprofit Management

Statement Of Financial Activities Nonprofit Accounting Basics

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels Business Tax Deductions Small Business Tax Deductions Tax Deductions

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Payroll Taxes

Statement Of Financial Activities Nonprofit Accounting Basics

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics